GEROITE NA SEVASTOPOL, operated by Navibulgar © Marc Ottini

[GUEST ARTICLE] Black Sea ro-ro service demand to Constanta continues to grow in H2 2022

Ukraine-based cargo analytical and consulting company Informall Business Group continues to watch the Black Sea ro-ro & ro-pax market developments in H2 2022 and shares their findings with us in this latest report from a war-torn country.

The Russian invasion of Ukraine on 24 February and Russian Navy aggression in the Black Sea disrupted ro-ro shipping patterns in the region. The most capacious ro-ro & ro-pax services on the routes that connect Georgia, Turkey, Romania and Ukraine were suspended shortly after the beginning of the war. With broken ro-ro & ro-pax supply chains the seaborne trade between Ukraine, Georgia and Turkiye was heavily affected.

Geographically, the Romanian port of Constanta appears as a well-located cargo gateway to Europe and an alternative logistics solution to the currently blocked Ukrainian ro-ro terminals. However, the lack of ro-ro & ro-pax infrastructure and, unfinished ro-ro terminal project development makes the port unfit for a mass ro-ro truck service at this point in time.

In the meantime, Russia continues to block all non- “Grain Deal” seaborne trades to & from Ukrainian Black Sea harbours leading to excessive cargo-handling service demand in the port of Constanta.

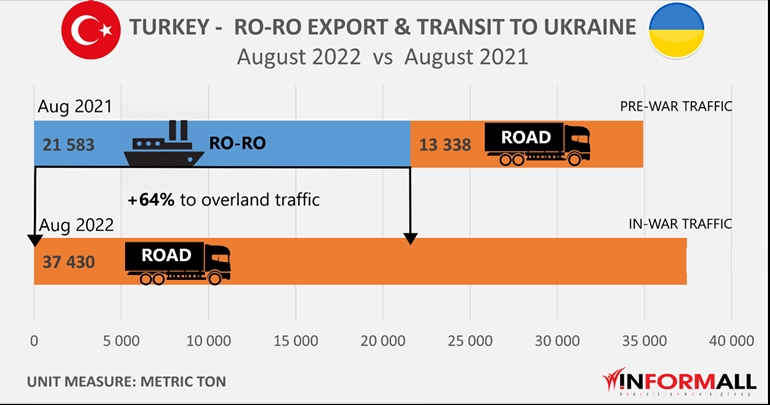

Turkiye to Ukraine ro-ro traffic has shifted to overland during the war

Informall BG’s market data shows that Turkiye-origin ro-ro traffic to Ukraine has shifted to overland routes since the beginning of the Russian-Ukrainian war.

A 64% overland cargo-traffic growth from Turkey to Ukraine is explained by the absence of alternative ways to deliver shipments to Ukraine under the current conditions.

Estimations show that 37,430 tonnes of various non-military cargoes have been delivered from Turkiye to Ukraine overland during August 2022. Despite the Russian war in Ukraine and difficulties related to the transit procedures for cargoes destined to Ukraine, Turkiye exporters delivered 7,2% more cargo than was shipped via combined ro-ro and overland transport routes prior to the war during the same month-period in 2021 – 34,921 tonnes.

Informall BG point out: “Ukrainian domestic manufacturing is currently affected by country-wide power outages which in turn boosts demand for import of ready-to-use products and humanitarian aid from abroad. At the same time, those operators who are looking for ro-ro/pax service establishment opportunities between Turkiye and Ukraine [via Romania] may find it challenging to ensure reverse cargo traffic to Turkiye as Ukrainian exports of non-food and non-grain products plunged during the war. While Ukrainian exports remain low, the UA-market under-capacity might be partially compensated on account of Romania, Hungary, Slovakia and Moldova export volumes to Turkiye”.

Turkiye ro-ro export opportunities via Romania

Ro-ro service establishment between Turkiye and Romania is still under development and ro-ro voyages from Turkey to Romania today are rather sporadic than regular service.

Traditionally, the import volume of food products from Turkiye to Ukraine and Eastern Europe increases during the winter-spring period, says Daniil Melnychenko – a data analyst of Informall BG. However, the lack of ro-ro service between Turkiye and Romania pushes truck carriers to cover long distances overland crossing multiple border points before reaching the final destination. In addition, overland cross-border procedures between Turkiye-Bulgaria-Romania do slow down road traffic destined for Ukraine increasing the product cost for the final consumers.

Although ro-ro service demand exists on this route, Vassiliy Vesselovski – CEO of Informall BG points out: “The recent ro-pax fleet booming demand constrained chartering availability on the market, meaning that opportunities for a new ro-ro service development from Turkey to Romania and from Georgia to Bulgaria and Romania might appear today as rather challenging”.

Observations shows that Ukrainian importers look into the Turkiye market more often during the war as Ukrainian container terminals remain blocked for the last nine months making the container logistics extremely complex and, importantly, time-consuming. Ukrainian importers are forced to use high-cost overland trucking services as no regular ro-pax service between Turkey and Romania has been established yet.

A major Turkiye-based ro-ro operator Cenk RoRo has relocated their fleet following the blockade of a Ukrainian ro-ro terminal in the port of Chornomorsk – one of their main destinations before the war. While part of the Cenk RoRo fleet has been redeployed beyond the Black Sea, two ro-ro vessels continue to sail within the region linking the Russian port of Tuapse with the Turkish ro-ro terminal in Samsun - GULISTAN U and FIRUZE G.

CENK Y, now FIRUZE G © Marc Ottini

Apparently, some ro-ro operators perform charter voyages from Turkiye to the Romanian port of Constanta irregularly such as the NAPOLI ro-ro vessel, which was bought by UkrFerry from the Grimaldi Group and handed over in June this year. Currently the vessel is on charter to Suardiaz though.

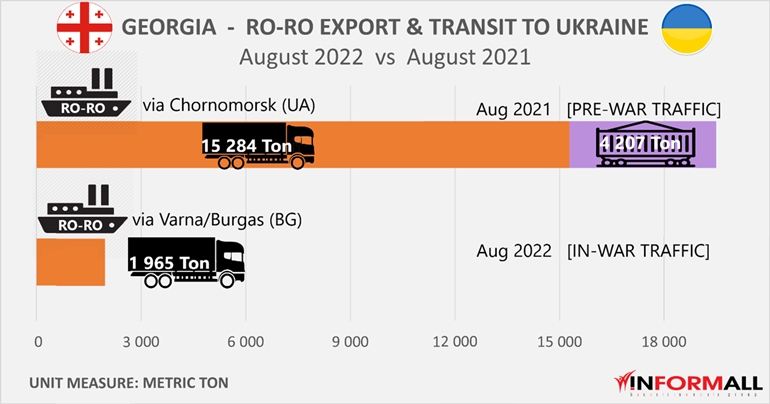

Georgia to Europe ro-ro transit opportunities

Georgia, being located at the crossroads of the Caspian region and the Black Sea region provides access to the “Middle Corridor” linking Central Asia and Europe economic regions via its ro-ro terminals in Batumi and Poti.

Estimations show that 19,491 tonnes of various cargo were transported from Georgia to Ukraine via ro-ro carriers in August 2021, however, once ro-ro service was suspended, Georgia’s export volumes to Ukraine plunged significantly by around 90% - to only 1,965 tonnes in August 2022.

Ukraine became a far- and hard-reaching destination for Georgian exporters and manufacturers. Most of the seaborne trade between Georgia and Ukraine were 100% dependent on the ro-ro service via the Black Sea as there is no suitable logistics alternative.

For instance, a unique [for the Black Sea] Chornomorsk (Ukraine) – Poti (Georgia) ro-ro railway service that used to be provided by UkrFerry was fully suspended after the beginning of the Russia-Ukraine war; meaning that the Georgia-Ukraine railway trade currently has no other options than to shift [where possible] to costly ro-ro trucking to Ukraine via Bulgarian ro-ro terminals in Varna and Burgas.

In the meantime, two out of four UkrFerry ro-ro vessels - KAUNAS and GREIFSWALD – that used to link Ukraine and Georgia are currently located in the Black Sea. KAUNAS is inactive and not in service since over two months, while GREIFSWALD is involved in Turkiye-trade.

UkrFerry's KAUNAS © UkrFerry

Today, only two ro-ro operators in the Black Sea provide regular ro-ro truck service between Georgia and Ukraine/Eastern Europe via Bulgaria.

Bulgaria-based Navibulgar operates the ro-ro vessel GEROITE NA SEVASTOPOL which runs on a line between Varna (BG) and Poti/Batumi (GE).

Another Bulgaria-based operator, Drujba Line, utilizes DRUJBA on the route connecting Burgas (BG) and Poti/Batumi (GE). As per Informall BG findings, both vessels operate at their trucking capacity and demand for the service remains strong.

Vassiliy Vesselovski suggests that ro-ro transit traffic via Georgia is due to grow in 2023 as Russia-EU transit restrictions are tightening up. An increase of ro-ro trucking capacity on the route between Georgia and Eastern Europe via Bulgaria/Romania is needed to meet the growing market demand for alternative trucking routes to Ukraine and the rest of Europe to/from the Caucasus and Central Asia countries avoiding transit via Russian “Silk Route” and Belarus.

Constanta ro-ro & ro-pax terminal development 2022-2023

Apparently, the port of Constanta’s expansion opportunities is limited due to the location and the surrounding city infrastructure. Although, according to a DP World-Constanta press release the port is working on a project worth USD 75 million that includes a ro-ro terminal expansion stage. The project will provide an extra 400 parking slots for freight trucks and a drive-through scanner with an impressive capacity of over 70 trucks per hour that will be installed at the ro-ro terminal area. One of the terminal features will be the possibility of loading trucks on railway carts for further transportation to the countries of Europe.

A new ro-ro terminal will add to the connectivity of the Caspian Sea market with European countries. The investment is planned to be operational early next year, and the entire construction process is projected to be finalized by the end of 2023.

Finally

Informall CEO adds: estimated demand for ro-ro services will remain strong and sustainable for the coming 2023 year for Turkiye-lines to Romania and Georgia-lines to Bulgaria and Romania. However, ro-pax charter rates and suitable tonnage availability will be a challenge. Finally, the ro-pax terminal development in Constanta is yet to be finished and put into operation before the port is ready to receive and handle mass ro-ro shipments in [est.] 2023.

© Shippax

dec 13 2022

Most read

The world’s largest battery installation on a RoPax got its final approval from the class

feb 18 2026